Our Assets

A balanced portfolio of assets

We are focused on the shallow offshore. We have built proven capabilities in exploration, appraisal, development, drilling, construction, and operation of assets in the shallow offshore area, as evidenced by the Anyala/Madu project in OMLs 83 and 85.

Oil Mining Licenses (OMLs)

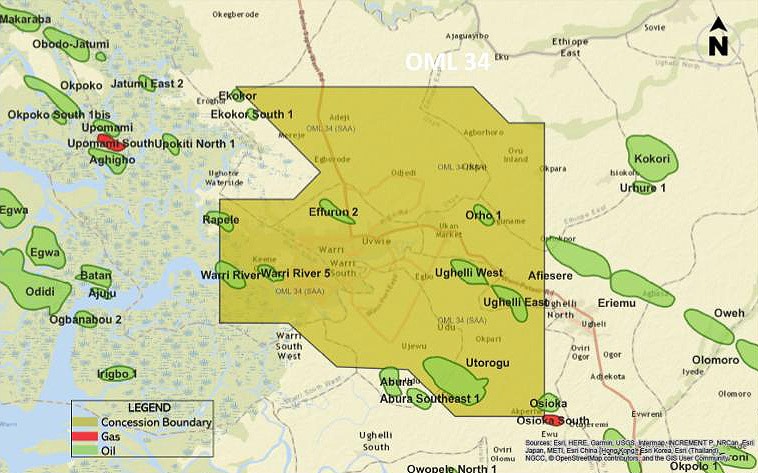

OML34

Land

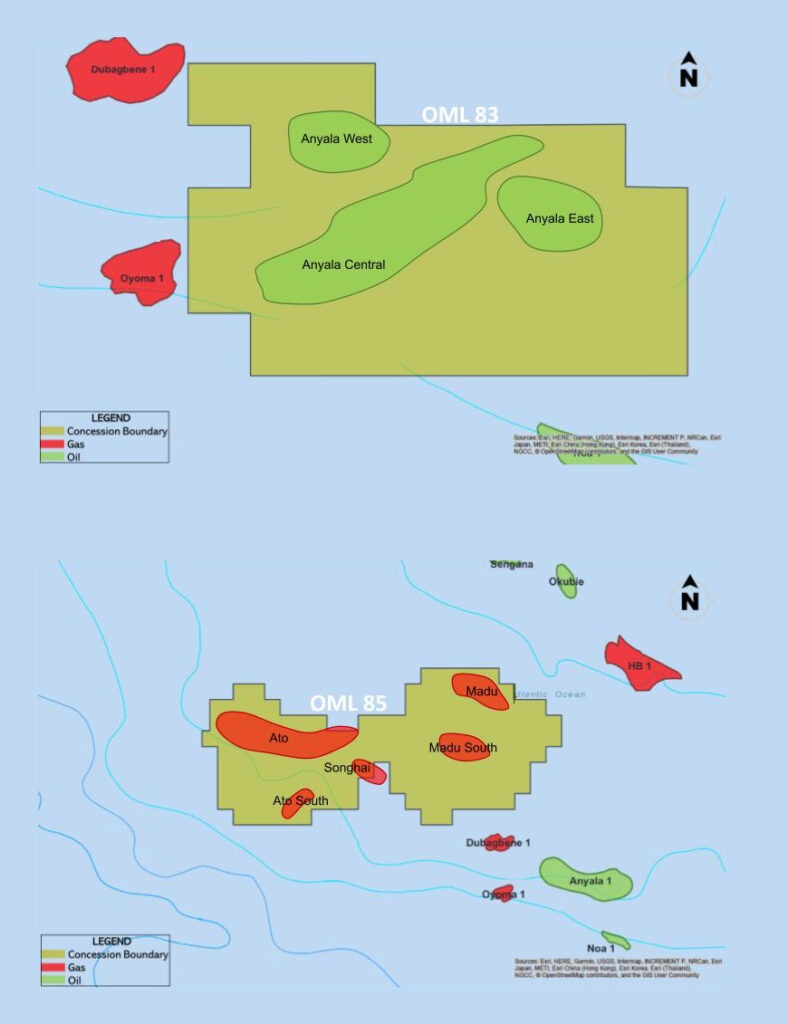

OMLs 83 & 85

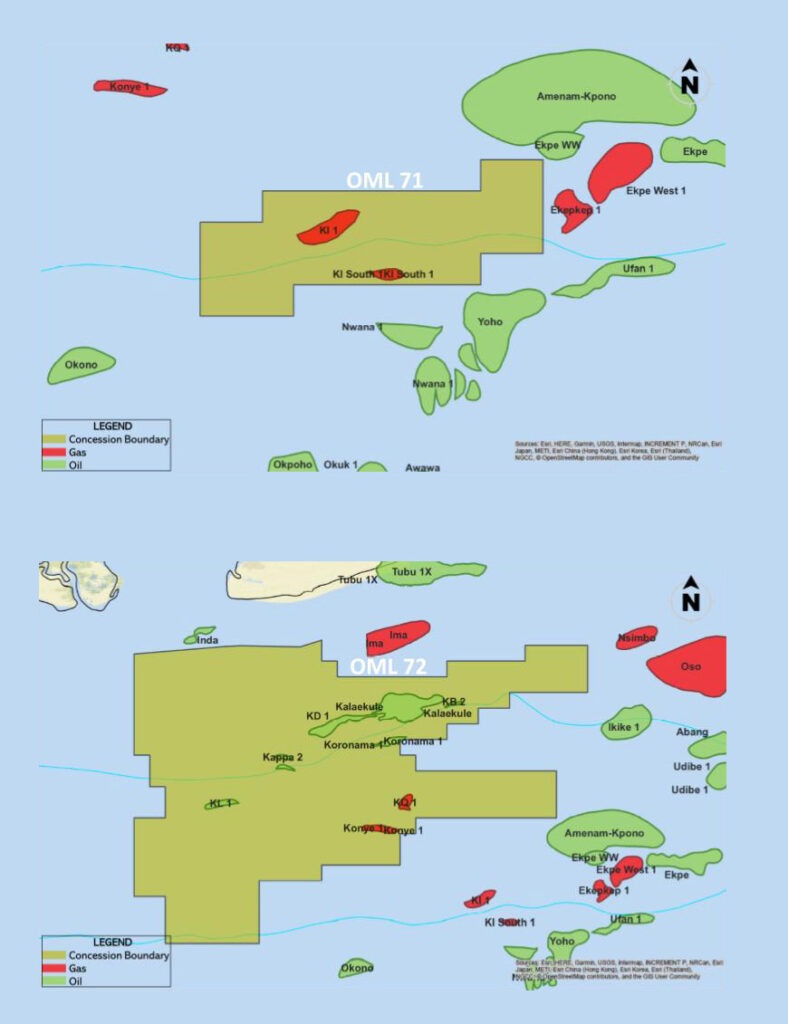

OMLs 71 & 72

Based on these acquisitions, we have established a strong foothold in the Shallow Offshore Niger Delta. We intend to strategically consolidate on these wins by ensuring our asset development plans, reserves addition strategy and portfolio growth plans are centred on the hubs defined by the locations of our existing assets and the trajectory of the EWOGGS pipeline.

Our portfolio consists of producing, near-term, development, and appraisal assets. We are also actively building up a ‘blue sky’ exploration portfolio that will be of interest to investors interested in the upstream business’s upside value.

See our Contact us page for interested investors

OML 34

In 2012, when the company was officially kickstarted, FIRST E&P acquired a 10% equity interest in ND Western Limited (NDW), which has a 45% interest in OML 34. The license is operated jointly by NDW and NPDC (Nigerian Petroleum Development Company). The acquisition in NDW provided FIRST E&P with immediate equity oil and gas production and the cash flow to invest in expanding its capabilities.

OML 34 is an onshore license block with four defined fields (Utorogu, Ughelli East, Ughelli West, and Warri River fields) and an extensive exploration scope with multiple prospects and leads across the block. The asset is strategic to Nigeria’s gas to power plan and currently delivers gas through Nigerian Gas Company to various power distribution companies and independent power plants.

The block has material upside potential and can realise production levels of 60,000 bbl/d oil and 600 mmscf/d gas based on the existing 2P reserves. The estimated HCIIP (Hydrocarbons Initially in Place) on the asset is 1,538MMstb (Million Stock Barrels) of oil and 8.057Tcf (Trillion Cubic Feet) of gas.

OMLs 83 & 85

FIRST E&P has a 40% working interest in OMLs 83 & 85 which are in the shallow waters of the Niger Delta in Nigeria. FIRST E&P is the operator of the two blocks, on behalf of the NNPC/FIRST E&P Joint Venture.

There are two main fields in OML 83 and 85: the Anyala and Madu fields. FIRST E&P commenced the green field development of those two fields with the acquisition of seismic across the licenses in 2018. The NNPC/FIRST E&P Joint Venture took Final Investment Decision (FID) in 2018 and commenced with drilling seven wells (eight strings) and the construction of two platforms. The Joint Venture leased an FPSO (Abigail Joseph) from Yinson. She was refurbished in record time in the Keppel shipyard in Singapore. The Joint Venture opted for Conductor Supported Platforms and splitter wellheads. This means that the footprint of the development is minimal. First oil commenced on 21st October 2020. The daily oil production is ramping up to 40,000 bbl/d by the end of Q1 2021, with a production plateau of 60,000 bbl/d in Q1 2022.

The two fields contain significant reserves and resources. The estimated HCIIP on the two fields is 581 MMstb of oil and 1.110Tcf of gas.

OMLs 71 & 72

FIRST E&P, in conjunction with Dangote Exploration Assets Limited and Dansa Energy Resources Limited (via a joint venture – West African Exploration and Production Company Limited (WAEP), acquired a 45% participating interest in OML 71 and OML 72 from Shell Petroleum and Development Company of Nigeria Limited, Total E&P Nigeria Limited, and Nigerian Agip Oil Company Limited (the ‘SPDC JV’). WAEP was appointed as the operator of the licenses. These licenses are located south of Bonny Island. There are seven discovered fields in OML 72: Kalaekule, KD, Koronama, Kugbe, KL, KQ, Kappa, while OML 71 has two main fields called KI and KI south.

Of all the fields, only Kalaekule has been developed under SPDC’s operatorship. The field was in production between 1986 and 2002 with average production of c.22,000 bbl/d and was shut-in by the SPDC JV in 2002 to allow for a planned refurbishment of the field facilities. The estimated HCIIP volume in OML-72 is 1,149MMstb of oil and 2.447Tcf of gas while OML 71 is estimated to have 158MMstb of oil and 1.4Tcf of gas, thus presenting an opportunity for significant oil and gas development.

East-West Offshore Gas Gathering Pipeline System - (EWOGGS)

EWOGGS is the single largest gas infrastructure investment in Nigeria's history to benefit domestic gas demand.

You may also be interested in

We are committed to creating a better and sustainable future for all especially with our stakeholder communities